Spherical Insights recently released a market research study identifying top banking trends in 2024. Among the most intriguing front office trends are:

-

- Hyper-Personalized Banking – Leading banks are using advanced analytics to assess each customer’s end-to-end journey. This involves mining data from a spectrum of sources (biometrics, service interactions, digital channels, etc.) to create a clearer picture of who the customer is. Then the banks utilize real-time insights/predictive tools to improve the customer journey, position more relevant offerings, and increase revenue.

- Customer Service Chatbots – Banking customers are turning to bots to answer questions, analyze their account, and execute rudimentary transactions 24/7. This is freeing bank employees to build deeper relationships and help customers address larger financial milestones.

- Application of AI – AI is being baked into almost every component of banking. Without AI, hyper-personalization and self-service bots are not possible.

Banks can leverage Salesforce Financial Services Cloud + Einstein Bots to capitalize on all of these trends and better serve their customers in 2024. Let’s explore how this can be done.

Hyper-Personalized Banking

In 1947 ‘It’s a Wonderful Life’ idealized the image of George Bailey as the banker that cared. George knew his customers and he ran a bank that had a big heart. They helped their neighbors purchase affordable housing, make it through job gaps, and fund small businesses. In fact, for those of us that entered finance, George was probably who we wanted to be when we grew up.

Of course, in the real-world we have too many customers to be close personal friends with every one of them. What we can do is use technology to know enough about them to show that we care. Salesforce Financial Services Cloud enables a bank to create these moments that matter across every stage of the customer’s journey, leaving ‘breadcrumbs’ of empathy along the way. By walking through a journey scenario, we can see what a difference this makes.

Bridget, a financial advisor at a bank, is running a campaign to identify clients that need wealth management services. She defines her target audience (net worth +$2M, residing in US, under 55 years of age) and uses Actionable Segmentation to create a list of individuals that fit her target audience description. This is achieved in Salesforce by creating a dataset that draws from Account, Contact, and Financial Account objects. The resulting list tells Bridget who would benefit most from her wealth management services. In addition, it gives her context for each individual to improve her ability to reach out at the correct time, proactively understand their needs, and build a relationship.

During Bridget’s outreach, she connects with David. He has been putting off his personal retirement planning to expand his technology business and recognizes the growing urgency of retirement as his 50th birthday approaches. David is concerned that he has not saved enough to retire at 60. He will need a reliable income and he does not want to sell his business because he plans to pass it on to his daughter.

Bridget listens to David’s concerns and she uses Salesforce Financial Goals to help him plan for retirement. Together they determine that David needs a steady income of $200K per year to retire and maintain his current lifestyle. Fortunately, David has some 401K savings already and they estimate that he needs to allocate an additional $65K per year to meet his goal in 10 years. Bridget creates a Financial Goals FlexCard for David that combines Salesforce and external data about the market. It shows David’s risk aversion, current portfolio value, and status to goal.

After discussing the plan, David shares his vision for his retirement. He tells Bridget that he has a cabin in Montana and plans to spend most of his time fly fishing in the summer. In the winter, he hopes to ski and snowshoe. Bridget listens and enjoys the conversation with David. After the call, Bridget uses Interest Tags to assign Fishing and Skiing tags to David’s record.

One month later, David books a ski trip. David has consented to share intent and purchase data with third parties, thus his ski data is fed to the bank’s Salesforce platform. A Salesforce drip marketing campaign is initiated. Einstein Content Selection assesses the external ski information, the Ski Interest Tag, and David’s Financial Goals FlexCard. Einstein generates an email with a picturesque image of a man in his early 60s skiing down a majestic mountain and the caption “Retire On Your Time”. David sees the highly personalized ad, recalls his pleasant conversation with Bridget, and remembers some of the goals he committed to himself. He clicks on the prompt to set another meeting and the invite appears on Bridget’s calendar.

Bridget accepts the invite. Prior to the meeting she reviews David’s account information to jog her memory of the conversation and to assess the digital journey he has taken over the last month. She also reviews David’s progress toward his retirement goal and conducts market research to determine how progress can be continued. David is impressed by how prepared Bridget is in the meeting and they make some portfolio adjustments to inch David closer to his retirement goal.

It is important to note that Salesforce is not a silver bullet for empathy. No technology can “make Bridget care about David”; however Salesforce can serve up the information and tools to give Bridget the opportunity to care. By freeing Bridget from the stress of redundant tasks and presenting humanizing information about David, Bridget has a chance to relate to him. Then her thoughts, feelings, and personality make the interaction real.

Given that the human element of this equation is so important, Frontline 1st recommends starting with an art of the possible session to design the ideal future state customer journey. Once leadership aligns, build Salesforce capabilities to support the journey. As always, if your team finds itself stuck, give Frontline 1st a call. We are happy to share our experience.

Customer Service Chatbots

Einstein Bots are exciting and they have a spectrum of self-service applications in the banking industry. As a result, the most common mistake we see banks make when building bots is trying to tackle too much at once. To avoid falling into this trap, a bank should first determine what challenges the bot is trying to solve for. To achieve this:

-

- Talk to customers to discover the pain points in their journey

- Talk to employees to understand their roadblocks and workarounds

- Review internal data to identify manual tasks that are wasting significant time (ex. one client discovered that 38% of all customer calls were to reset passwords)

- Analyze points of revenue leakage (unanswered sales inquiries, abandoned transactions, etc.)

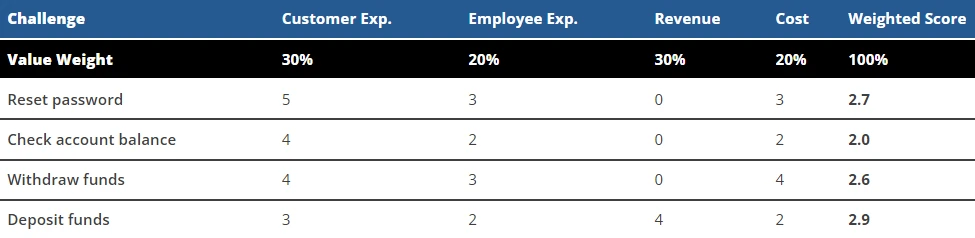

Once a Mutually Exclusive Collectively Exhaustive (MECE) list of challenges has been created, develop a weighted scorecard to determine the value of solving each challenge. An abbreviated version of the scorecard may look something like the following:

| Challenge | Customer Exp. | Employee Exp. | Revenue | Cost | Weighted Score |

| Value Weight | 30% | 20% | 30% | 20% | 100% |

| Reset password | 5 | 3 | 0 | 3 | 2.7 |

| Check account balance | 4 | 2 | 0 | 2 | 2.0 |

| Withdraw funds | 4 | 3 | 0 | 4 | 2.6 |

| Deposit funds | 3 | 2 | 4 | 2 | 2.9 |

Ensure that all of the challenges can be addressed by Einstein Bots. If they cannot, then eliminate them from the list. Next, sort the list to bring the highest Weighted Scores to the top. Focus on solving the top three.

Next quantify success for the Einstein Bot. For example, the Einstein Bot might aim to “execute 32% of the bank’s deposits in the 6 months following launch”. If possible, estimate the ROI that would result from achieving this in terms of employee hours saved, revenue generated, or some other bottom-line KPI. Confirm that each ROI is above the bank’s desired threshold before moving on.

Build a detailed customer journey that outlines how the Einstein Bot will deliver the expected value. To see a customer journey example, reference the third paragraph of the Hyper-Personalized Banking section of this article.

The Einstein Bot customer journey should address experience driven questions, such as:

- When does the customer realize the challenge?

- How will the customer know to use the Einstein Bot?

- What channel will the interaction take place in?

- What will be the conversation flow?

- How long will the customer need to digest the information (i.e., length of conversation pause)?

- What tone (business/personal) will the customer expect?

- What will occur if the bot misunderstands the customer?

- When should the customer have the option to transfer to a human agent?

- How might the customer feel before, during, and after the interaction?

As the Einstein Bot is designed, involve both business and technical teams. A common mistake Frontline 1st sees banks make is engaging the technical team too late in the process. This can lead to technically inefficient/unfeasible designs.

Next, test the Einstein Bot with internal users to validate that the desired use case is achieved. As this is done, ask the internal users to put themselves in the customer’s shoes and describe not just what they are doing, but what they are feeling. Watch for words such as “frustrated”, “confused”, etc. Often feelings are a better indicator of Einstein Bot success than “could I complete X task using the bot”. Most of these feeling red flags can be addressed prior to launch to improve the probability of success.

After thorough testing, deploy the Einstein Bot and listen carefully to customer feedback. No matter how many resources are applied to design/build/deploy, there will be feedback. The most successful Einstein Bots are the result of experimentation and iteration.

In addition to listening to customers, assess the Salesforce data that the Einstein Bot is generating. Seek answers to questions that could inform better Einstein Bot design, such as:

- What are the most common conversation paths being selected? Least common?

- When are customers asking for an agent? Why?

- Is the Einstein Bot content fresh? Are old industry/cultural references being made?

- If free text responses are allowed, what do they tell us about how the customer is feeling (ex. curse words entered)?

If your bank still has open questions about Einstein Bots, reach out to Frontline 1st. We can discuss our lessons learned and provide guidance.

Key Takeaways

- Recent market research indicates that in 2024, leading banks will continue to focus on providing hyper-personalization to customers.

- Salesforce Financial Services Cloud enables hyper-personalization by empowering a bank to:

- Identify the customers that would benefit most from specific offerings

- Reach out in a timely, informed, and relationship-driven manner

- Build custom financial goals and track progress

- Develop and deliver catered drip marketing campaigns

- Give bank employees the opportunity to care about the customer’s vision and advancement toward goals

- Market research shows that many banking customers are leveraging bots to address basic questions, understand their account, and conduct simple transactions.

- Einstein Bots should be leveraged to enable customers to self-serve, but don’t boil the ocean. Before building an Einstein Bot, develop a MECE list of challenges and use a scorecard to determine the value of solving each challenge. Next:

- Focus on solving the top three challenges in the score card

- Forecast the ROI of solving each challenge and confirm each ROI is above threshold

- Build the customer journey and refine it with the technical/functional team

- Align on the Einstein Bot design

- Build the Einstein Bot, conduct internal testing, and address feedback

- Deploy the Einstein Bot and address external feedback

- Analyze data that the Einstein Bot is generating and consider enhancements